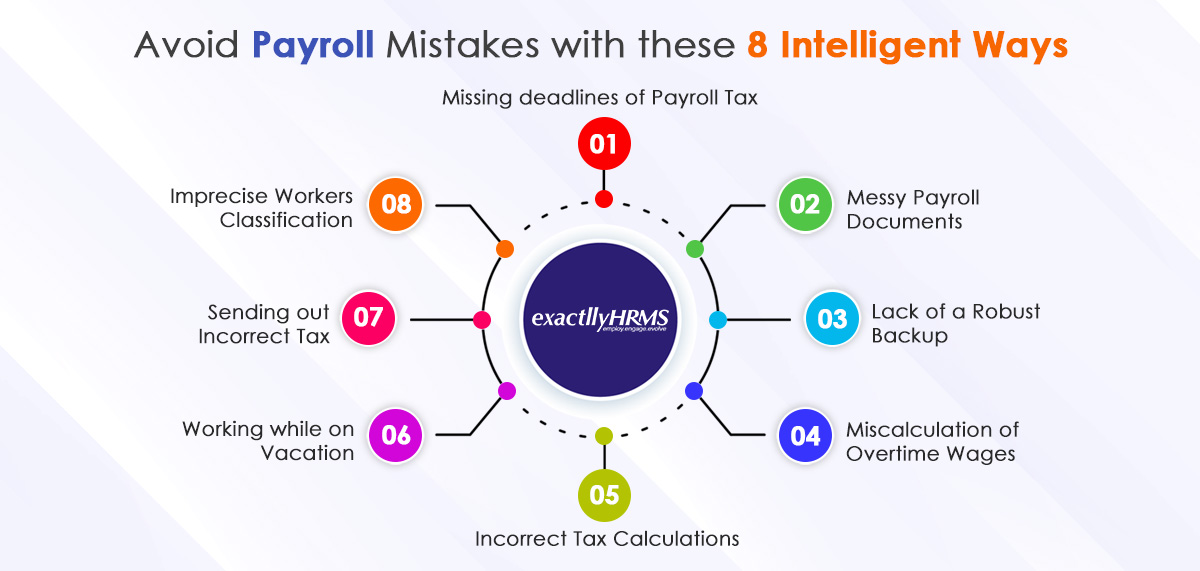

Avoid Payroll Mistakes with these 8 Intelligent Ways

Organizations that are still using paper and pen for workforce time record-keeping are not operating in the correct way. By depending on shift schedules for calculating payroll, it is just leaking money and is also making itself vulnerable to IRS penalties. Payroll has a very important role to play in protecting the reputation of an organization. Hence, it can never afford to commit payroll mistakes. The payroll errors can cost organizations huge sums of money annually. To manage payroll processes in the correct manner, it is imperative to avail of payroll services. Businesses with this won’t experience any harm if we look at it from the perspective of net revenue.

Intelligent Ways of Avoiding Payroll Mistakes:

In the cutthroat competition, not a single business can meet the expense of committing payroll mistakes. Let us now learn which payroll errors are quite common and how to avoid payroll mistakes. The ways are listed below:

-

Missing deadlines of Payroll Tax –

A properly functioning payroll system is a must for business as it can save organizations from deep trouble. Missing the deadlines of payroll tax can bring in legal troubles that will lead to a poor reputation for that organization. There will also be a lot of financial stress as then bearing late remuneration penalties and disbursing huge late charges will be a necessity. It will also create distrust among the employees. The most intelligent way of managing such payroll errors is by investing in an all-inclusive Human Resource Management Software. These software solutions will never let any company forget the due dates of the payroll tax.

-

Messy Payroll Documents –

Not using digital media for payroll calculations is one of the biggest payroll mistakes that a company can make. Keeping updated backups becomes hassle-free with HRMS integration software solutions like Exactlly. Paper timesheets will always be a liability for any organization as these are perishable. Any swapping or manual alteration will lead to zero records of the modifications made. Information can get displaced as well. Hence, payroll documents can never remain messy or else it will be catastrophic for any organization.

-

Lack of a Robust Backup –

It is commanding for every company to carry a strong backup for payroll data. Suppose a company’s payroll manager decides to quit working or suddenly there is a PC crash. What happens in that kind of situation? The effects can be devastating as, without backups, it will be impossible to calculate payroll for the employees. Such payroll errors can be costly. Storing backups of the payroll data in secure locations is equally important. This is making many businesses invest in a cloud-based payroll system for storing backup safely. Going through the HRMS features list is important before investing in a particular software solution.

-

Miscalculation of Overtime Wages –

It does not matter what the size of the organization is. The workforce won’t stay if the management does not calculate the overtime wages of employees correctly. If not the organization will owe penalties and wages. HR managers can prevent committing these payroll mistakes by taking the help of payroll services as well. Alternatively, the company can also invest in HRMS software for handling miscalculations.

-

Incorrect Tax Calculations –

Something that is always changing is the tax laws. It becomes even more difficult to keep track of when the business is prevalent in more than one location. Paying incorrect tax rates is one of the most serious payroll errors that an organization can make. It must avoid payroll mistakes like this at any cost or else it might get penalized. One way of avoiding it is by keeping a check on the tax rates of employment every year so that the business remains aware of the updated rates of tax.

-

Working while on Vacation –

Shift schedules, workforce reporting and time clocks are some of the ways of calculating payroll. But certain payroll errors can occur as well like accidental misclassification of payable time and overlapping of the time clock admittances. A business might need to pay a lot more due to these errors. For instance, suppose an employee is on a holiday but due to some urgent requirement, has to complete some tasks remotely. But the records might tell that the employee is on paid leave. Solving these little things can become headaches later.

-

Sending out Incorrect Tax Forms –

A business can only run successfully when it complies with tax laws like excise tax and income tax. A company can submit the taxes at a particular time by the IRS. But sometimes payroll managers file the tax returns preceding the specified due date. Hence the IRS penalizes such companies. This kind of payroll error can only be avoided in intelligent ways. The best way of avoiding this is by sending out the correct tax forms to the workforce and at the correct time. The payroll department also must have access to correct data like tax file numbers, employee names and a lot more.

-

Imprecise Workers Classification –

Workers misclassification is a very typical payroll error that a business can make. A company carries two kinds of workers – independent contractors and full-time employees. But sometimes employers misclassify the two kinds of workers. For instance, few employers pay minimum wages to contractors. Along with this, few employers misclassify the full-time workers as contractors due to which they miss out on the wages. Not treating the freelancers like the full-time workers and appointing a dependable payroll service provider are few ways of avoiding such mistakes

Final Say:

The payroll mistakes that an organization can make are now clear to us. Whether intentionally or unintentionally, these payroll errors can cost fortunes for organizations. But the good news is that avoiding these payroll mistakes is possible with careful planning. Either a business can outsource payroll services where a group of payroll experts look after the payroll calculation of employees and tax calculation or implement a software solution like exactllyHRMS. The Free Demo contains more information. Contact Us today.

FAQ:

(1) What are the common mistakes that happen during the Payroll Process?Missing deadlines, improper record-keeping, overtime pay miscalculation and not saving the payroll records are few common mistakes that take place during the payroll process. (2) How long does a company have to fix a Payroll Error?An employer can subtract the upcoming paycheck to correct the error. Making adjustments is only possible by the employer when he detects it within ninety days of the mistake when it first occurred. (3) How do you avoid Payroll Mistakes?By sending the correct tax forms to the workforce by the right time and guaranteeing that the payroll department has entry to precise employee data are some ways of preventing payroll mistakes (4) What happens if your employer accidentally overpaid you?If the employer accidentally overpaid you, then he/she has the right to retrieve the money back. There is an exception though which is section 14 of the Act. Employers with this Act can make the deduction and rectify the error. (5) How often should you reconcile Payroll?Payroll reconciliation must be performed for each pay period after the interfacing of payroll expenses into the FMS or financial management system. (6) What happens if a company pays you by mistake?When a company pays you by mistake, it is lawfully entitled to recovering the amount from the individual to whom it had by mistake disbursed the salary. (7) Can an employer collect overpayment?The employer can subtract the entire overpayment amount to the workforce even if it lowers the employee’s wages below the minimum wage for the period of pay. (8) How do you ensure accuracy in Payroll?Communicating properly with the staff, proper employee classification, automating the payroll process, checking legal compliance are some of the ways of ensuring accuracy in payroll. (9) What Payroll services include?The payroll services include the generation of electronic records of payroll to relevant parties, guaranteeing precise payroll tax, recording employee attendance and a lot more |