Tax laws applicable to our country prescribe duties to be charged on goods and services on their import and export. Under the erstwhile/current indirect tax regime, excise tax, service tax, customs duty, VAT are all charges on the tax treatment of imports and exports. Under the GST regime, all these taxes have been subsumed into a single tax or the GST. The customs duty however will be continued to be levied additionally. In this article, we have highlighted the differences in the tax implications for exports and imports by drawing a comparison between the two regimes.

Current / Erstwhile Regime –

| Description | Example | |

| Import of Goods |

|

F&M Clothing based in Maharashtra purchases garments from Lara Fashion in Spain to a total value of INR 1,00,000. The customs duty is charged at 10%, CVD at 12.5% and the SAD at 4%. Therefore, the total cost of import will be the total value of the garments plus the total tax paid on the garments. |

| Import of Services |

|

F&M Clothing based in Maharashtra hires designing services from Spain and the total value of the services is INR 5,00,000. The service tax is payable at 14%, additional taxes such as krishikalyancess and swachh bharat cess are at 0.5% each. The total cost of importing the service will thus be the cost of the service plus the added taxes. |

| Exports |

|

GST Regime –

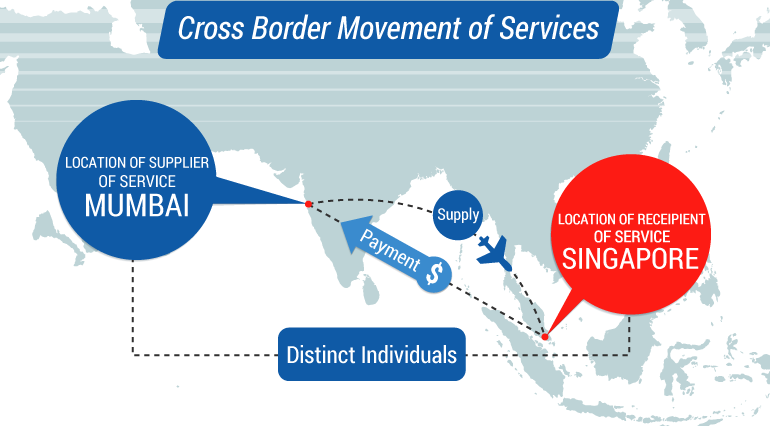

For example: Rohan Consultants in Mumbai, Maharashtra, provides business consultancy services to Abey’s Engineering in Singapore. The payment for the service has been received in Singapore Dollars.

Here,

Location of supplier: Mumbai, Maharashtra

Location of recipient: Singapore

Place of supply: Place of supply will be the location of the recipient, i.e. Singapore.

Payment for the service: Payment for the service has been received in convertible foreign exchange, i.e. Singapore Dollars.

Relationship between the supplier and recipient: The supplier and recipient are distinct persons.

Hence, this supply qualifies as an export of service. Rate of tax on the supply will be 0%.

The levy of taxes and treatment of taxes in case of imports and exports largely remain the same under GST in comparison with the existing laws. In case of an importer, full input credit will be available on the IGST paid on imports and additional input credit will be available on the GST paid on all types of inputs used or intended to be used in the course of or for the furtherance of business. Similarly, in the case of an exporter, refund will be given on the tax paid on all inputs used in the course of business. Overall, costs of import and export are expected to reduce under GST and compliance is expected to become easier with the convergence of multiple tax laws into one law.

Leave a Reply